Expertinasia delivers innovative IT solutions, empowering businesses with cutting-edge technology for growth and digital transformation.

Expertinasia delivers innovative IT solutions, empowering businesses with cutting-edge technology for growth and digital transformation.

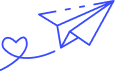

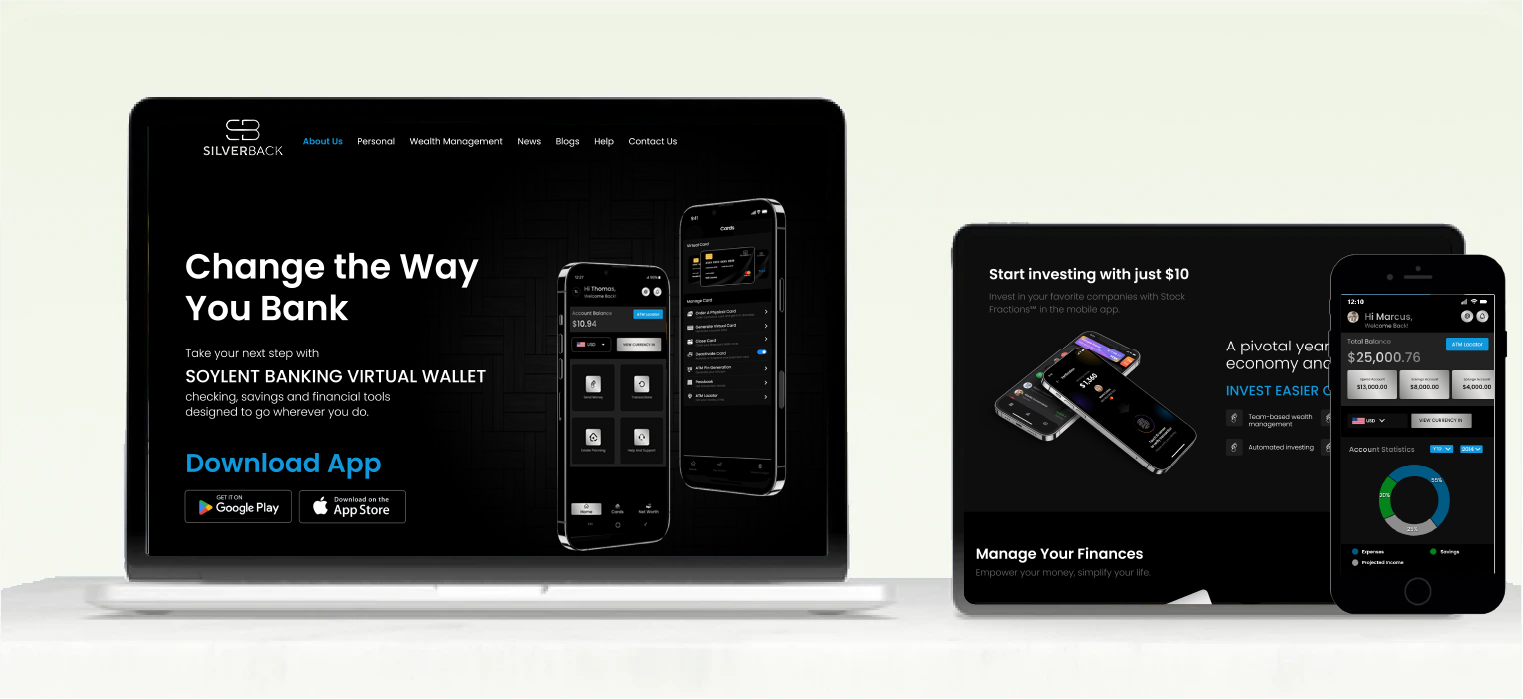

SB Banking developed by Expertinasia is a cutting-edge fintech platform designed to simplify and optimize financial management. Our mission was to create a unified solution that combines secure transactions, advanced analytics, and customizable tools to enhance decision-making and support business growth.

With SB Banking businesses and individuals can manage their finances more effectively, utilizing real-time tracking, secure payments, and actionable insights. Our platform empowers users to make data-driven decisions with confidence, ensuring financial success and sustainability.

SB Banking a fintech platform developed by Expertinasia was tasked with creating a comprehensive solution that empowers businesses and individuals to streamline their financial operations. As the platform evolved, the complexity of managing diverse financial needs, ensuring secure transactions, and maintaining a seamless user experience grew. The team needed a robust, scalable platform that could integrate advanced financial tools while offering an intuitive interface for users with varying levels of expertise.

SB Banking aimed to distinguish itself by offering secure, real-time transaction processing, customizable financial tools, and advanced analytics to help businesses make data-driven decisions. The goal was to provide a solution that could serve businesses seeking financial optimization and individuals looking to better manage their finances.

The primary challenge was to build a platform that could handle complex financial transactions while ensuring ease of use, scalability, and security. It had to provide both high-level financial insights for businesses and straightforward tools for individuals, all within a unified platform that ensures a smooth experience across both web and mobile interfaces.

Customer Satisfaction: A 35% increase in user satisfaction scores due to improved digital services.

Operational Efficiency: Reduced processing time by 40% with automated workflows and faster transaction systems.

Compliance: Maintained a flawless compliance record while enhancing security measures.

SB Banking offers a seamless financial management experience with features such as:

These features combine to provide a fast, efficient, and secure financial experience for all users, helping them achieve their financial goals with ease.